Monitor Weekly [2025-06-29]

"Put all good eggs in one basket and then watch that basket."—Andrew Carnegie

Welcome to the tenth week of my portfolio monitoring!

This week, we're discussing Text's annual results and reviewing the latest information from the PlayWay Group, as shared by their CEO.

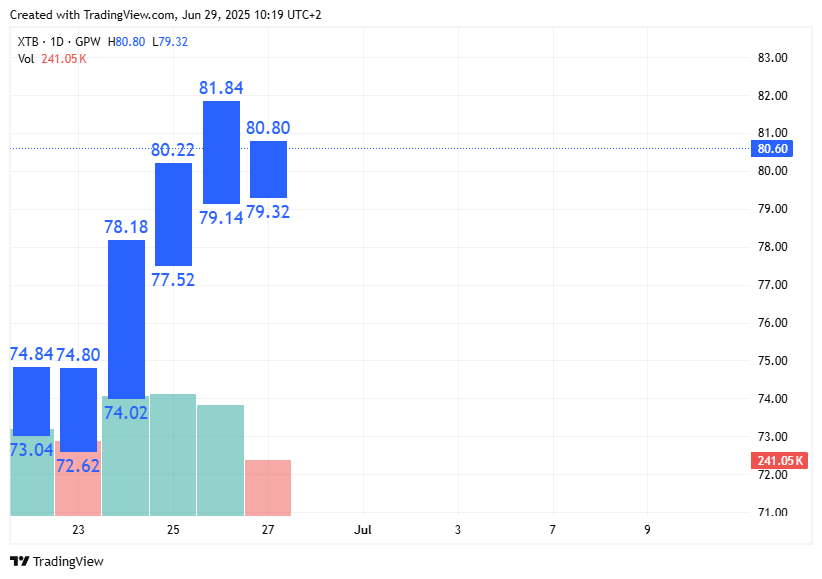

XTB.WA (74.84, +14,55% since April 11th)

This week, XTB's share price climbed by nearly 8%, fully recovering the losses incurred from the PLN 5.45 dividend detachment.

This increase is likely partially attributable to reports of a newly launched AI chatbot. This bot addresses basic client inquiries regarding platform operations, support, and investment offerings. The AI bot generates responses based on articles from the help center, documents, regulations, and a database of frequently asked questions. This new tool is currently available to users in Poland, the Czech Republic, and Portugal, with plans for rollout to additional markets served by the company in the coming weeks.

XTB clients using the bot can, at any point, request to be redirected to a consultant for further assistance. Messages generated by the bot are clearly marked and include source information in the form of links to articles on xtb.com.

The team responsible for developing and implementing AI-based technologies at XTB has been operational since late 2023. Initially, their focus was on streamlining internal company processes and deploying tools for employees. After one year of the AI team's work, over 60% of XTB employees were reportedly using the solutions it developed daily.

The AI chat is the first artificial intelligence tool available to the broker's clients. The company plans to further develop the bot, and in the near future, it is expected to evolve into a virtual assistant capable of recognizing returning users and providing them with personalized support based on previous inquiries and their activity within XTB. Furthermore, there are plans to enable the chatbot to answer questions concerning various indicators for selected companies and specific financial data.

I'm particularly pleased to see XTB's capability in developing and leveraging AI tools.

The second positive piece of news is the reappointment of the entire current management board for another three-year term on June 25th. This suggests that the current management remains committed to XTB's growth and has a clear vision for its future.

Don't miss out on the latest XTB news! Subscribe to my weekly newsletter and have key developments delivered conveniently to your inbox!

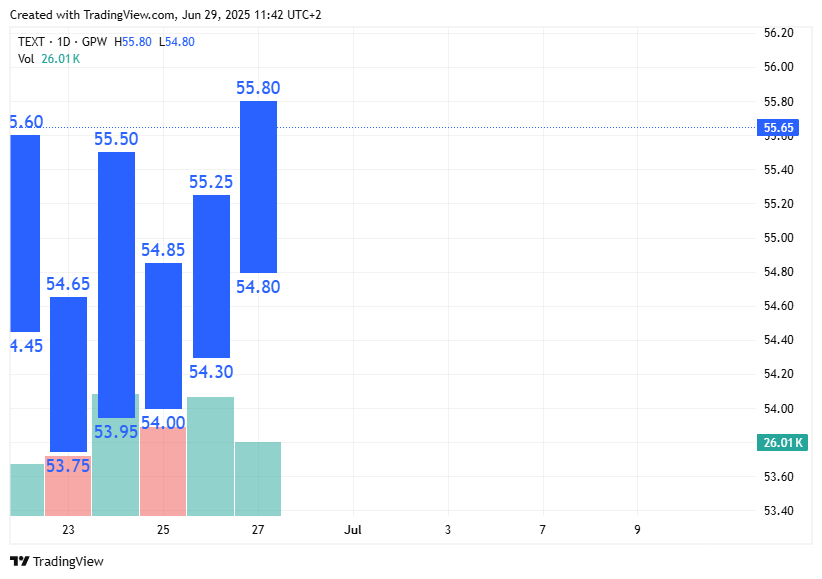

TEXT.WA ( 55.65, +8% since April 22nd)

Leading up to the release of Text's Q4 fiscal year results, the stock price saw a slight uptick.

However, in my view, the results published Friday after market close weren't groundbreaking. Text reported a net profit of PLN 36.8 million for the fourth quarter of the 2024/25 fiscal year, marking a 3.4% year-over-year decrease and falling short of the PLN 39.9 million consensus. This translates to an annual net profit for the company of PLN 164.4 million, a 1.3% decline compared to PLN 166.6 million in the 2023/24 fiscal year.

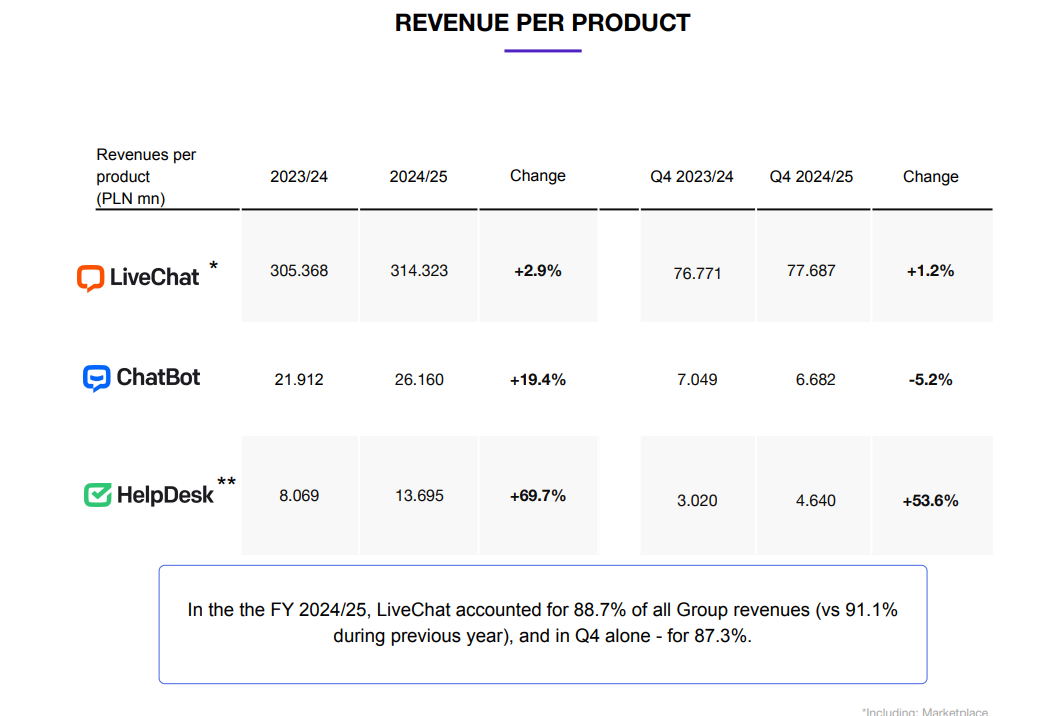

Conversely, revenues exceeded expectations, coming in at PLN 89 million for Q4 FY2024/25, a 6.8% year-over-year increase, despite the consensus anticipating PLN 88.8 million. Annually, this represents a 5.6% increase in revenues, from PLN 335.4 million to PLN 354.2 million.

Text primarily attributes these results to the weakening of the USD against the PLN. As they state, "The Company generates almost all of its revenues in USD, while its costs are incurred both in USD (marketing, IT infrastructure, affiliate program) and in PLN (mainly the team and the leasing of the office in Wrocław)." Additionally, increased costs related to the migration to new cloud infrastructure are cited, with this migration expected to conclude in the second half of the 2025 calendar year.

Key Performance Indicators (KPIs) for TXT appear to remain stable. The group's Monthly Recurring Revenue (MRR) at the end of the fiscal year stood at USD 7.12 million, a 6.9% year-over-year increase. As of March 31, 2025:

LiveChat's ARPU (Average Revenue Per User) was USD 181.9, up from USD 178.6 at the end of December 2024, and USD 160.1 a year ago.

ChatBot's ARPU was USD 147.3, compared to USD 144.3 at the end of December 2024, and USD 134.5 a year ago.

HelpDesk's ARPU was USD 225.1, up from USD 210.2 at the end of December 2024, and USD 153.4 a year ago.

During the quarter, the number of paying LiveChat customers decreased by 1,423. The company explains this by stating, "The recorded result was significantly affected by sunsetting of native tickets in this product." Customer churn remains high, with "closing, changing business model" cited as the number one reason for departures given by departing customers. Despite this, LiveChat's revenue increased.

What's encouraging is the stable growth of products beyond LiveChat, along with the declared record dividend. The Management Board proposes to the AGM (Annual General Meeting) a dividend payment of PLN 6.06 per share (taking into account previous interim dividend payments). The Management Board has also requested the Supervisory Board's consent to pay a second interim dividend of PLN 1.51 per share. The proposed Dividend Record Date is July 23, 2025, and the Payment Date is July 30, 2025.

Given that Text unconventionally distributes dividends three times a year, an advance payment of PLN 1.66 was already made in January 2025, and PLN 1.51 is stated for July. This means investors in Text can still anticipate an additional payment of PLN 2.89 per share. Therefore, an investor purchasing Text shares today could expect a return of nearly 8% from dividends alone.

In summary, I am currently holding my Text shares, minimally counting on the company's ability to at least maintain its market share and continue paying substantial dividends.

What are your thoughts on Text? I'd love to hear your opinion. Feel free to share your comments below and let's discuss!

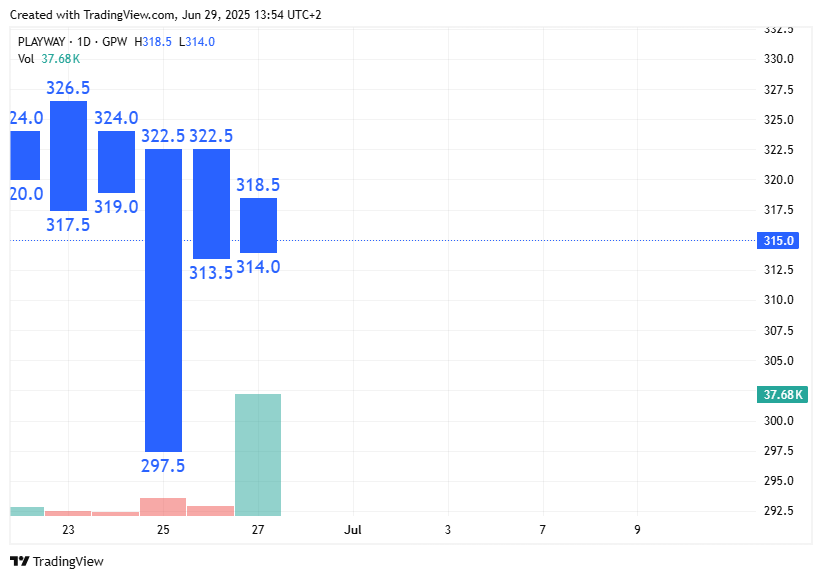

PlayWay (315, +4.48% since May 12th)

PlayWay's share price has slipped by a few PLN since last week. One potential reason for this could be the weakening of the US dollar against the Polish Złoty.

Today, PlayWay's investor relations department published a discussion of the latest news from the PlayWay Group by CEO Krzysztof Kostowski, hence the delay in today's newsletter.

Most of the information presented had already been covered by me in previous editions of Monitor Weekly. However, among the more significant, previously unmentioned updates, the CEO proudly announced that Wrap House Simulator has generated over half a million USD in revenue from Steam, confirming the game will be developed for consoles. Crime Scene Cleaner has already brought in over USD 10 million from Steam. Furthermore, the console release of Contraband is practically complete.

The CEO also reiterated his investment approach: they invest in companies producing low-cost simulators, with the expectation that one out of several investments will yield a multi-fold return and significant success.

Tomorrow, a crucial vote will take place regarding the record dividend of PLN 22.55 per share from the company. The proposed dividend record date is July 8th, with the payment expected on July 15, 2025. At current PlayWay share prices, the dividend yield stands at over 7%.

What are your thoughts on XTB, Text or Playway? I'd love to hear your opinion. Feel free to share your comments below and let's discuss!